Once you become a merchant, you use Novae’s online platform, branded with your logo, to request financing for your customer.

INTRODUCING

NO FEE DTC

(Direct to Consumer)

Consumer Financing

Offer financing options with Novae to increase your conversions and revenue and PAY 0% MERCHANT FEES!

Get paid quicker

Get paid more

Get paid often

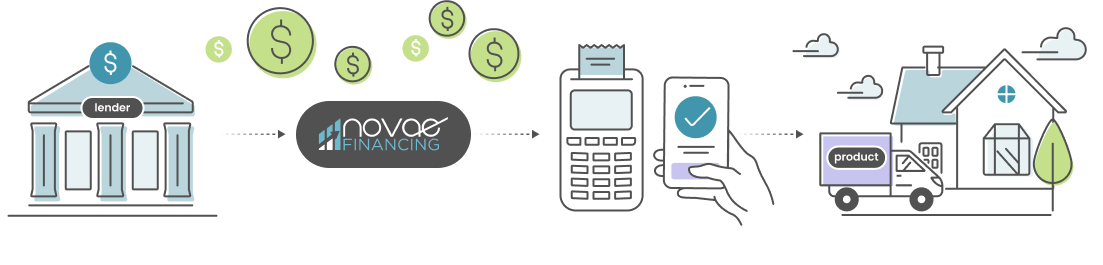

How Novae’s DTC Financing Works

The financing request is sent to Novae’s multi-lender network.

If a partnered lender accepts the request, the consumer may receive a loan, line of credit, or alternative form of funding.

If the customer is approved, he or she will receive the funds in full within two to three days. You invoice the customer, we’ll help with a template, and you get paid from them within 48 hours of them receiving the funds.

Why Novae DTC Financing?

Boosts sales

Save THOUSANDS by not paying ANY FEES

Improves customer acquisition

Maximizes cash flow

HIGHLIGHTS

- Finance up to $250,000

- Loan Terms of up to 72 months

- Approvals down to 515 credit score*

- 30 Lenders, no industry restrictions

- Merchant Fee -

flat 5% per loan0% for LIMITED TIME

(0% locked in as long as your account is active) - APRs starting at 5.99%

MERCHANT REQUIREMENTS

- No underwriting requirements

- All merchants approved

WHAT YOU GET

- Co-branded webpage to send customers

view example - Unique application page link

- Track application submissions

- Agreement to retrieve funds from customer

Why Novae?

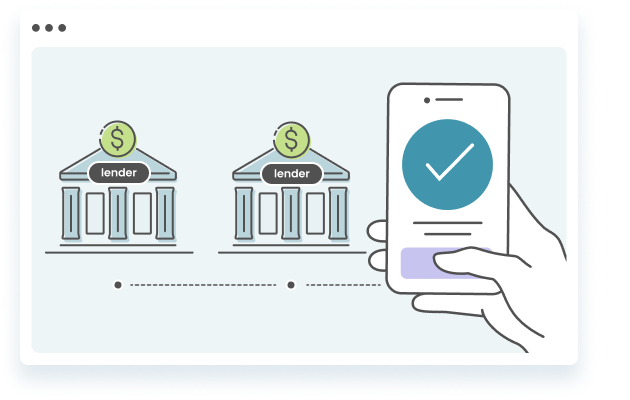

Novae partners with a reputable multi-lender network and utilizes a waterfall algorithm to improve approval rates. This means consumers have a higher likelihood of finding financing options.

Novae only conducts a soft credit check to minimize the impact on a consumer’s credit score. Also, many of our partnered lenders may be willing to work with damaged credit applicants.

Novae charges 0% on all your financing volume on our platform. Our competitors charge on average 5%! So if you’re processing $100,000 per month, that’s $5,000 in savings monthly. If you’re processing $1,000,000 per month, that’s $50,000 in savings monthly! Only pay Novae a FLAT $50/mo platform fee!

Your customers will have more opportunities to get financed due to Novae's multi-lender network! One application sent to over 30 lenders, with no impact on their credit!

Novae provides ongoing 5 star customer service, 5 days a week, including an IT team and for accounts processing over $100k/mo, a dedicated account manager.